It's safe to say that we can call the annual ranking of AR investments a holiday tradition at Next Reality.

Following our 2018 and 2017 editions of the biggest AR investments, we've expanded the list to include the top 25 this year.

While there are many familiar names at the top of the investment mountain (three companies have earned mentions in all three editions), this expanded list gives us an opportunity to highlight some of the newer startups receiving smaller seed funding rounds to get off the ground as well as established companies closing smaller rounds in 2019.

#25 — Eyecandylab ($1.5 Million)

There's a lot of repetition and overlap when it comes to AR technology, but startup Eyecandylab has a unique proposition: instead of image markers, its AR platform uses video markers. The company closed a $1.5 million seed funding round in August 2019 with participation from Viacom, NBCUniversal, WWE, and Softbank. The startup's technology has already found its way into the real world via an AR app built in partnership with South Korean carrier LG Uplus that interacts with home shopping TV network programming.

#24 — DeepMotion ($2.2 Million)

This is the first time Samsung makes an appearance on this list, but it won't be the last. Samsung Venture Investment Corp., along with Scrum Ventures, led a $2.2 million funding round into DeepMotion in March 2019. The startup specializes in Digital Avatar Solutions that uses physics simulation, computer vision, and machine learning to facilitate AR experiences.

#23 — Medivis ($2.3 Million)

One of the more head-turning solutions for HoloLens is its ability to give sensory superpowers to doctors and surgeons, so it's not surprising that investors have their own interest in technology that leverages the spatial computing capabilities of the headset. Enter Medivis and its surgical software for HoloLens, SurgicalAR. The startup closed a $2.3 million funding round in Feb. 2019.

#22 — LIV ($2.6 Million)

While other developers are pursuing the nascent realm of AR gaming, LIV has its eyes set on the growing e-sports arena. The startup scored $2.6 million in funding in Nov. 2019 to build out its platform for AR game streaming for spectators. LIV will apply the funding toward accelerating the development of its platform and to court third-party studios.

#21 — WarDucks ($3.8 Million)

Game developer WarDucks raised $3.8 million in funding in March 2019 to create location-based augmented reality games. Concurrent with the funding round, the startup hired Doom mastermind John Romero.

#20 — Upskill ($7.6 Million)

One of the leading enterprise AR platforms on the market, Upskill continued to add to its warchest in 2019. The company raised $7.6 million of its $12 million goal based on an Oct. 2019 filing with the Securities and Exchange Commission. The company raised an undisclosed amount in a Series B round in 2017 followed by a $17.2 million round in 2018.

#19 — Scape ($8 Million)

AR cloud and visual positioning services are key technologies to making the next generation of AR experiences, including AR navigation and immersive multiplayer gaming, a reality. Add Scape to the companies jockeying for position as the go-to platform for these experiences, as the company closed a seed funding round of $8 million in Jan. 2019. The funding enabled the startup to launch its mobile SDK, Scapekit, for iOS, Android, and Unity.

#18 — Scope AR ($9.7 Million)

Enterprise AR software maker Scope AR is one of the more surprising entries on this list. Founded in 2011, Scope AR raised a $9.7 million Series A round (typically the second level of investment for startups after the introductory seed round), in March 2019. If anything, the event is a testament to sound financial management and steady growth over its tenure before returning to investors.

#17 — Emerge ($12 Million)

A startup with DNA from Google, NASA, Raytheon, and Daqri, Emerge...ahem...emerged from stealth in Nov. 2019 with a $12 million funding round, bringing its total to $18 million. Emerge has several AR irons in the fire, including tabletop and social AR games, connected toys for education, and meditation and well-being products, such as virtual pets. The company's next plans are to continue its growth and begin engaging Unity developers in 2020.

#16 — Waveoptics ($13 Million)

After placing at #10 the past two years, waveguide maker WaveOptics has dropped a few spots (and actually benefits from this year's expansion of the list). The company initially raised $26 million in Dec. 2018 for a Series C funding round and proceeded to add another $13 million to the same funding round in Sept. 2019. The latest investment carries more intrigue than in previous years, as Goertek, a contract manufacturer with a client roster that includes Google, Microsoft, and Sony, has not only participated in the funding round but also struck a strategic alliance to include WaveOptics waveguides in its reference designs and white-label products.

#15 — Nreal ($15 Million)

China-based Nreal is one of two companies on this list to gain notoriety for its efforts to launch a consumer-grade smartglasses product, in this case, the Nreal Light. The company closed a $15 million funding round concurrently with its star-making appearance at CES 2019 in January. While the startup has begun accepting preorders for the $1,100 developer edition of the Nreal Light ahead of the 2020 launch of its more modestly-priced consumer edition and has weathered a legal challenge from Epic Games, Nreal still faces a lawsuit launched by Magic Leap against Nreal CEO (and NR30 up and coming AR founder) Chi Xu.

#14 — Augmedix ($19 Million)

If Augmedix sounds familiar, it is because it is one of several software companies (including Upskill) that built platforms for Google Glass during its explorer phase and has since benefited from Google's pivot to the Google Glass Enterprise Edition. The healthcare-focused company closed a $19 million Series B funding round in Oct. 2019 to continue development of its platform and scale the service to more healthcare providers. If there's a better example of failing upwards than Google Glass, I can't think of it.

#13 — ThreeKit ($20 Million)

Retailers have bought into augmented reality as a means to enable customers to preview products in their homes. That means that companies like Threekit, which gives companies the ability to create 3D content from design files, are in demand. With a client list that includes Crate & Barrel, CIROC, Tailored Brands, and Modarri, Threekit has parlayed its platform into a $20 million funding round, which it closed in Nov. 2019.

#12 — Prophesee ($28 Million)

It appears that $28 million was a popular funding target for AR startups, as we have a three-way tie at the tenth spot. Formerly known as Chronocam, Prophesee closed a $28 million round in Oct. 2019, bringing its total funding to $68 million. The Paris-based startup will apply the funds toward its Metavision sensor and the computer vision software that goes with it. In addition to AR, the company has plans to expand the solution to VR, autonomous driving, and industrial IoT systems.

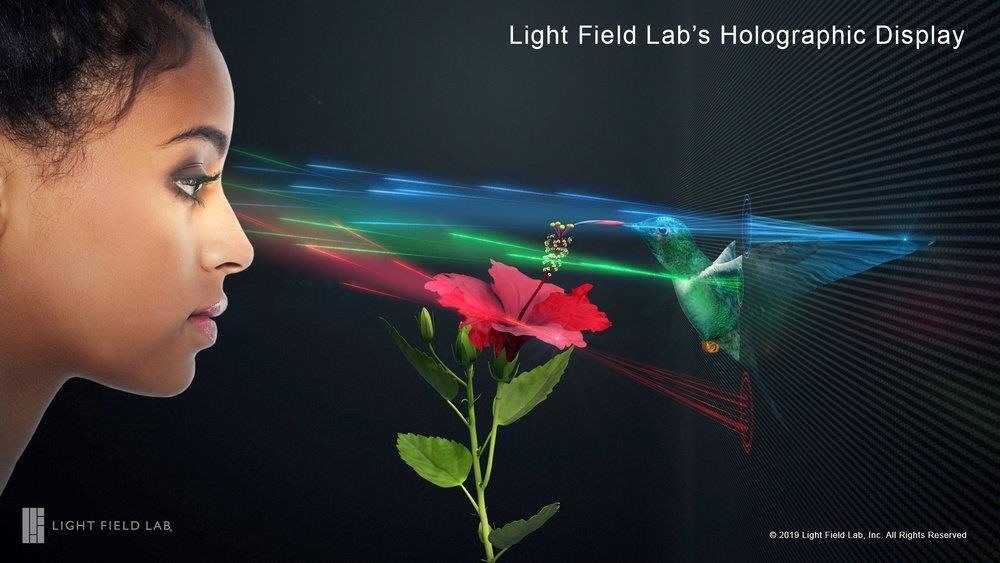

#11 — Light Field Lab ($28 Million)

With $28 million in funding raised in Aug. 2019, Light Field Lab's Series A funding round was exactly four times the size of its seed round from 2018. The holographic display maker attracted an all-star roster of investors, including Samsung, Verizon, Comcast, Liberty Media, Bosch, and NTT Docomo among the participants.

#10 — CTRL-Labs ($28 Million)

After back-to-back trips to the top 10 of AR investments, brain control interface startup CTRL-Labs slipped a bit in these rankings, but that's not a bad thing. In Feb. 2018, the company replicated its 2018 funding round with another $28 million funding round, with GV, Google's venture capital arm, leading both rounds. The startup then made its exit via an acquisition by Facebook.

#9 — North ($40 Million)

It's been a big year for North. Like Nreal, the company drew attention for its consumer-grade smartglasses, Focals, as well as iterative software improvements to add utility to the product. The company ran into some financial struggles early in the year that led to some layoffs, but it rebounded with a $40 million funding round. Oh, and unlike Nreal, you can actually walk into a store and buy Focals right now, a Warby Parker-style move that will likely be replicated by Apple when it enters the smartglasses space.

#8 — Matterport ($48 Million)

Matterport is no spring chicken, having earned a reputation as one of the top 3D camera makers. Now, as the demand for 3D content creation has reached a fever pitch, the company is capitalizing on that demand. In March 2019, Matterport closed a $48 million funding round for its cloud platform for 3D content, a nearly ten-fold increase over its 2017 funding round.

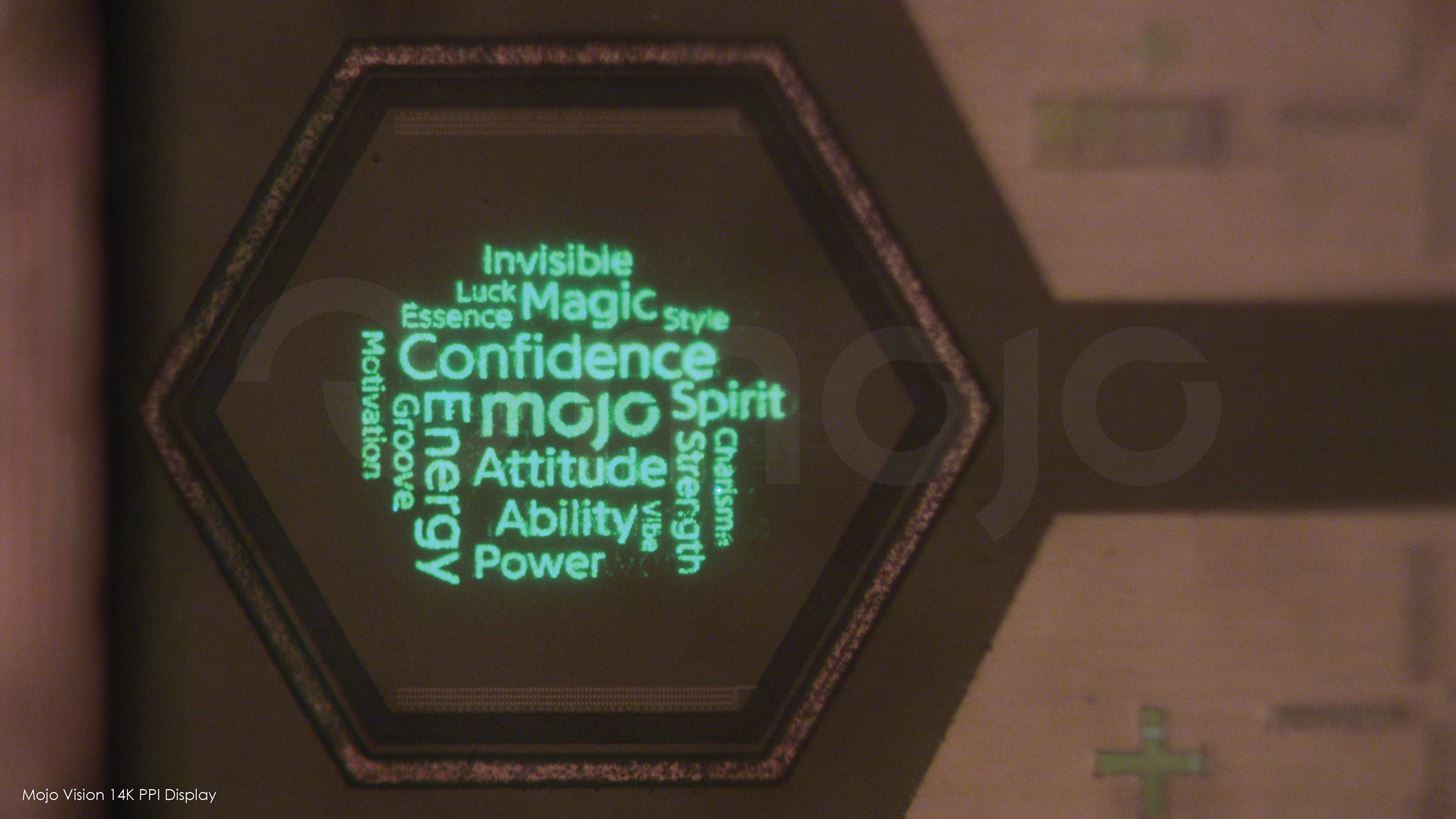

#7 — Mojo Vision ($58 Million)

After emerging from stealth in 2018 with a $50 million funding round and a mysterious "invisible computing" product, Mojo Vision closed a $58 million round in March 2019. Apparently, this was enough for the company to unveil its first product offering, a microscopic display for AR wearables.

#6 — DigiLens ($50 Million)

DigiLens was an honorable mention in last year's edition, but a $50 million funding round in 2019 (double its 2018 round) places the waveguide maker in the top 10 this year. We usually see Niantic on the receiving end of investments, but this time it's filling the role of investor along with one of its own investors, Samsung. Both companies have a vested interest in seeing DigiLens grow and contribute to the maturation of the consumer smartglasses ecosystem.

#5 — RealWear ($80 Million)

The enterprise-grade AR wearables from RealWear aren't sexy, but they are attractive enough to land investment dollars. In July 2019, industrial automation company Teradyne, Inc. led an $80 million investment round that included participation from Bose Ventures, Qualcomm Ventures, and Kopin Corporation, among others. Until a viable mainstream AR wearable product hits shelves, investment in utilitarian smartglasses for enterprise will be the norm, so get used to it.

#4 — Vayyar ($109 Million)

It's rare to see a relative unknown among the top five, so props to Vayyar. In Nov. 2019, the imaging company closed a $109 million Series D round led by Koch Disruptive Technologies, the technology investment arm of Koch Industries. The funding enables Vayyar to further develop its core technology, sensors that can track and map industrial environments in real-time, and expand its market footprint.

#3 — Niantic ($245 Million)

Technically, we listed Niantic's $245 million funding round when it was first reported as a $200 million round in 2018, but it didn't close until 2019, so here the AR gaming pioneer is again. With that funding round, not only did Niantic launch its long-awaited Harry Potter game, but also it has accelerated the development of its Real World Platform for AR cloud gaming. Samsung was among the participants, clearly enamored with the prospects of more AR games for its smartphone ecosystem.

#2 — Corning ($250 Million)

After funding Corning International with $200 million from its Advanced Manufacturing Fund in 2017, Apple has doubled down in 2019 with another $250 million in Sept. 2019. While the company currently gets love from Apple and other smartphone makers for its Gorilla Glass, it also has display solutions for smartglasses in its product pipeline. The investment comes as Apple's timeline for releasing its first AR wearable has, according to some sources, slipped to 2022.

#1 — Magic Leap ($280 Million & counting)

Magic Leap is basically the Alabama Crimson Tide of AR fundraising. The company might not always finish the year at #1, but it will be near the top. Since Next Reality began recapping the top AR investments in 2017, Magic Leap has ranked no worse than second.

However, the company's 2019 funding totals are the lowest of the three editions, with a $280 million investment from NTT Docomo announced in April 2019.

But there's still just under a month to go in the year, which is plenty of time for CEO Rony Abovitz and crew to pad its lead, as they are working on a Series E funding round. However, with the departure of its chief financial officer, perhaps that process slows down a bit and doesn't conclude until 2020.

Honorable Mentions

With the top investments list expanded to include 25 companies, there's not much left to address in terms of honorable mentions. Nonetheless, there are a few ancillary items in AR financial developments that are worth highlighting. While not a 2019 investment per se, it's safe to say that the investors behind Onshape are having a happy holiday season, as PTC acquired the 3D CAD company for $470 million in Oct. 2019. With a total of $150 million in funding raised over the company's existence, that's a pretty healthy return on investment.

After falling into administration (UK's version of bankruptcy) in Dec. 2018, Blippar was rescued by one of its existing investors, Candy Ventures. The company placed a successful bid on the company's assets and relaunched the startup with a more-focused mission.

Epic Games launched a $100 million fund called Epic Megagrants, with awards ranging from $5,000 to $500,000, to developers creating 3D experiences in Unreal Engine. The company also offered up 500 Magic Leap One headsets to participating developers working on spatial computing apps.

Finally, the Knight Foundation invested $750,000 in five museums to facilitate the deployment of immersive technology. While it pales in comparison to some of the investments in our top 25, a six-figure investment can still buy a museum a handful of HoloLens 2 or Magic Leap One headsets.

Evaluating the 2019 AR Investment Landscape

When comparing the top 10 investments in 2019 to the results of 2018 and 2017, it would appear that this has been a down year for AR investment.

The top 10 investments in 2019 represent $1.19 billion in funding, down from $2.26 billion in 2018 and $1.82 billion for the same grouping. The top-funded company in 2019 closing just $280 million, compared to $1.25 billion in 2018 and $502 million in 2017. 2019 is also one of the tighter rankings at the top, with just $10 million separating the first and third spots.

Moreover, we saw the fall of early AR hardware makers Meta Company, ODG, and Daqri. And then there was the acquisition of Leap Motion for a reported $30 million, a far cry from from the $50 million funding round the company closed in 2017.

Is this sign of a dip in the AR market? Have the failures of several AR companies scared off investors? Or are we at a stage of maturity where companies are turning previous funding into actual revenue? 2020 will be a telling year as to the direction of the industry.

Additional reporting by Adario Strange

Just updated your iPhone? You'll find new emoji, enhanced security, podcast transcripts, Apple Cash virtual numbers, and other useful features. There are even new additions hidden within Safari. Find out what's new and changed on your iPhone with the iOS 17.4 update.

Be the First to Comment

Share Your Thoughts